Former West Carthage Paperboard Seeks Funding for Specialty Paper Production

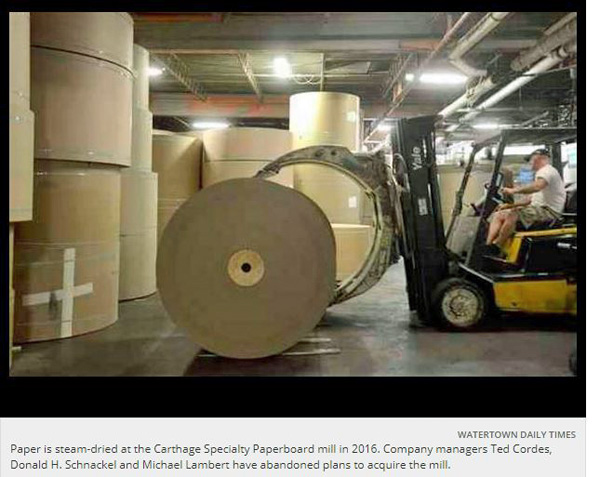

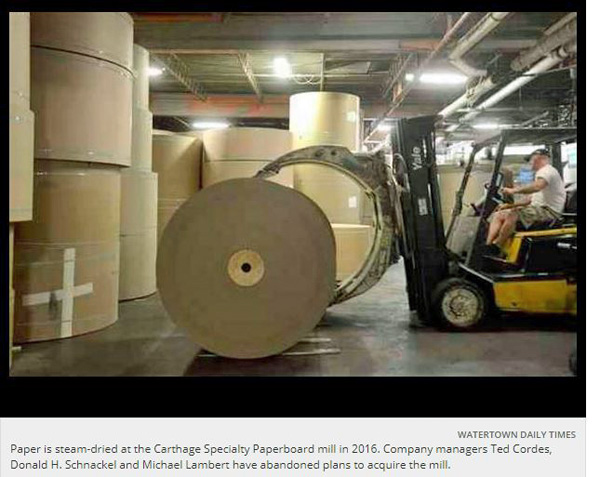

According to a report Wednesday (Aug. 29, 2018) by the Watertown Daily Times (Watertown, N.Y., USA) an investment firm from Washington state hopes to take over the bankrupt Carthage Paperboard (pictured below) n the state and is seeking public funds to aid in its endeavor to switch production to other types of specialty paper.

Human Capital Investments plans to submit a purchase offer for the manufacturer, which makes paper products including mat board and cap closure board at 30 Champion St., West Carthage, as well as upgrade its plant, retain its more than 70 former employees, and eventually hire even more.

Ben Rankin, one of the principals of Human Capital, said there is "clearly a need" for specialty paper product makers, and he aims to fill that need, keep the local manufacturer afloat and recapture markets lost to competitors in Canada and Finland by increasing production and possibly its product line. He said he spoke to a number of vendors who were familiar with the local paper company, and his Human Capital business partner, principal Phil Farmer, toured the mill.

The paper machine operates at 60% capacity, but Rankin said it could operate at 85%. He said he hopes to increase its output from 40,000 tpd to 70,000 tpd in a few years.

"The machine is capable of making other specialty paper products," he said. "Once we own (the company), we’ll be able to take advantage of our current customers’ needs because they’re actually hungry for more product."

Human Capital has also considered purchasing the former Metro Paper Industries plant, 695 West End Ave., Carthage, and "other various additional options in the area," Rankin said. Metro Paper (Toronto, Canada) shut the doors of its Carthage plant in 2016, laying off 20 workers.

Carthage Specialty Paperboard’s owner, DeltaPoint Capital Management LLC, filed for Chapter 11 bankruptcy in February after years of setbacks and a failed attempt to sell the manufacturer. Its assets will be sold at auction as part of the restructuring process.

Human Capital plans to submit a bid through its subsidiary, Long Falls Paperboard, Rankin said, adding that he expects the court will hold the auction in October.

To help finance its purchase, Rankin said the company has been working on securing a bond, although he declined to provide the amount. The firm also applied for a combined $1 million in loans from the Jefferson County Industrial Development Agency, the North Country Economic Development Fund and North Country Alliance.

All three organizations previously participated in a $1 million loan package for Carthage Specialty Paperboard with the Development Authority of the North Country and the village of Carthage in 2015. The loan provided the manufacturer with cash flow after it spent $3 million to upgrade its paper machine in 2014 .

Every organization save the village decided to write off the company’s bad debt this year.

"We’re excited to be a part of the community and we hope we will be," Mr. Rankin said, "and we hope the community will hold us accountable for doing what we say we’re going to do, which is to do our best to turn the company around and give it another hundred years."

The JCIDA’s loan review committee reviewed Human Capital’s request for a $300,000 loan at the agency’s office, 800 Starbuck Ave.. It recommended that the full board of directors consider it for possible approval.

Committee Chairman Robert E. Aliasso Jr. said if the board approved the loan, the firm would pay it back in four years at 6% interest, although it would only pay interest for the first 12 months.

"Or concern for the community is to encourage the process so the plant doesn’t close," said Donald C. Alexander, CEO of the JCIDA’s sister organization, the Jefferson County Local Development Corp.

The JCIDA previously approved a $250,000 loan for Carthage Specialty Paperboard CEO Ted Cordes, VP of Finance Donald H. Schnackel and VP of Sales and Marketing Michael Lambert, who wanted to submit a purchase offer for the plant and continue operating it.

David J. Zembiec, deputy CEO of the JCLDC, however, said the group was unable to secure other financial assistance to help them with creating an offer.

"They were no longer interested in the loan," he said, "so they dropped it."

Lambert said he didn’t hear "anyone I know mention anything" and the group would continue following the bid process. He declined to comment on whether officials would submit an official offer for the paper products manufacturer.

Matthew R. Siver, a project development specialist with DANC, said North Country Alliance’s loan review committee and the North Country Economic Development Fund plan to review Human Capital’s requests for $225,000 and $475,000, respectively, next month.

Siver said "we’re going to really have to ask the tough questions."

TAPPI

http://www.tappi.org/