The Current State of Recovered Paper Markets

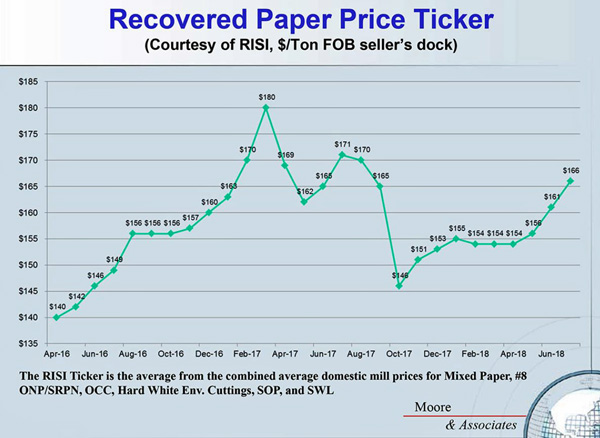

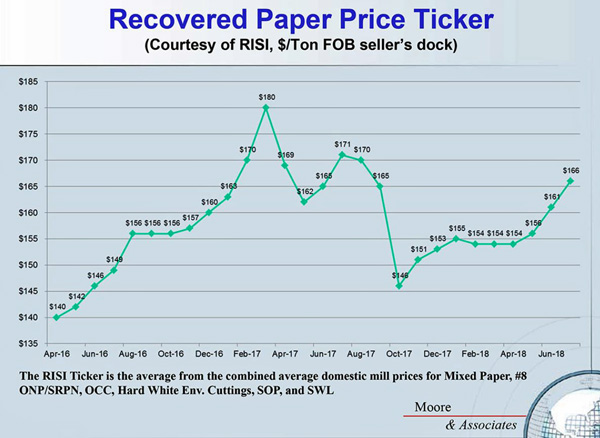

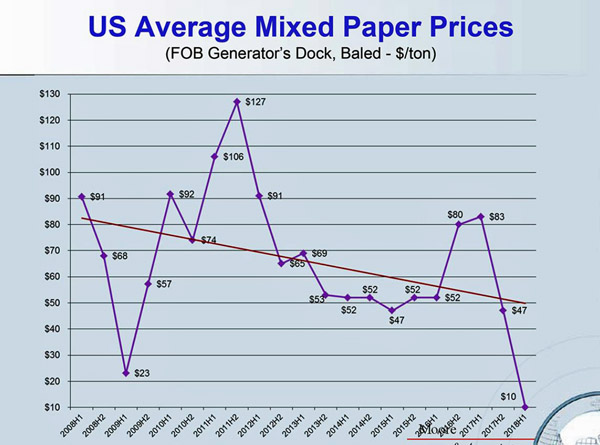

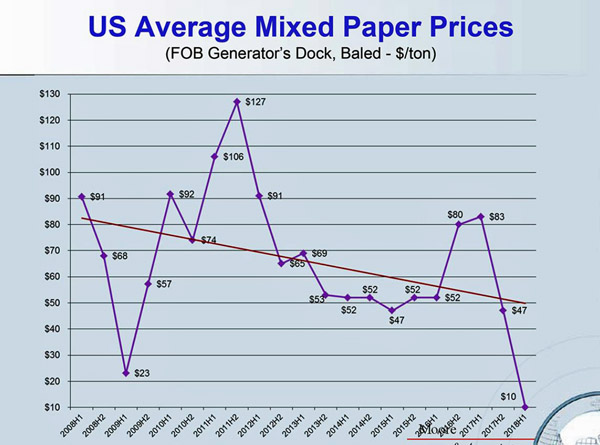

According to a Waste360 (Sarasota, Fla., USA) article published late this past month (July 26, 2018) during the summer of 2018, especially since China launched its ban on certain recycled commodities, much has happened in the recovered paper markets. During a recent Stifel Capital Markets conference call highlighted by Waste360, Bill Moore, president of Moore Associates, said he is remaining cautiously optimistic about the old corrugated cardboard (OCC) markets moving forward. He also reported that mixed waste paper (MWP) is at an all-time low and that demand is strong for finished paper product to be converted into boxes.

"Going forward, we clearly made a bottom in OCC prices, and we’re starting to come off of that," he added. "But we expect mixed papers will go down and the high grades will continue to move up."

"We had a slight trendline down even before the China situation kicked in," Moore reported in regard to the prices of mixed paper. "I don’t see any rebound in mixed paper prices in the second half of 2018. It is possible that it will get a little worse, but I do think we’re kind of at or near the bottom, but I don’t see any uptick going forward for some time now."

He pointed out that domestic demand for OCC has been strong, while exports in China have been weak, and further noted that the U.S. domestic containerboard and corrugated box markets are very strong. He expressed optimism about the global market, noting multiple startups are developing in Europe, and new startups are coming into Southeast Asia. During this past month (July 2018) he said there was a continued announcement of more downtime in the China board and container production industry because they are short of fiber.

In the U.S., from 2016 through the first five months of 2018, he said there has been really no change in domestic mill consumption of mixed paper. But he saw some activity. One company in Australia has become a big user of mixed paper in its eastern U.S. mills. He noted that company has another mill planned in Ohio that’s currently under construction. In addition, he reported that international players, primarily China, are looking at putting systems into the U.S. to make pulp using mixed paper as a feedstock.

"Another mill beyond Ohio is very likely," Moore said. "Green Bay is the first big announcement of a new replacement mill, which will consume significant quantities of mixed paper. And then there has been a technology announcement from Georgia Pacific (G-P) about new technology to be able to use mixed paper, and they are putting a semi-commercial unit into a Toledo, Ore., mill aimed at using fast-food restaurants’ mixed paper streams."

For more information about G-P's new recycling technology, see OTW Aug. 9, 2018 edition: G-P Installing New Paper Fiber Recycling Technology at Oregon Mill

Moore went on to say that the recent Nine Dragons’ purchase of two mills in the U.S. indicates that China could still change its mind on the imports of mixed paper, and that both Chinese and traditional U.S. paper companies are examining whether they should vertically integrate backup in the chain to produce pulp.

"Because of e-commerce and OCC content levels going up in the bigger cities with higher e-commerce penetration, we’re seeing 30% to 40% higher OCC content in residential mixed paper," he noted. "That’s double what it was 10 years ago and quadruple what it was 20 years ago."

Currently he believes there is no trend for the conversion of high-quality OCC into pulp. However, that could change if China were to follow through with a decision to ban outright all imports of recovered paper by 2020.

TAPPI

http://www.tappi.org/