RBC Tissue Tracker: Good March Stats and Some Other Good News

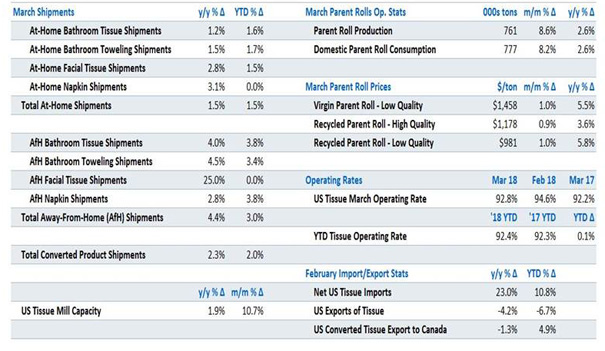

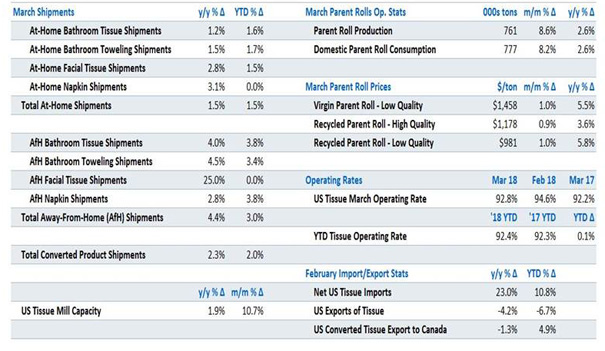

March U.S. tissue stats continued to show a consistent and positive growth trend. Shipments for converted products remained strong, up 2.3% y/y (2.0% YTD), with particularly strong numbers from the Away-From-Home segment (+4.4% y/y, +3.5% YTD), along with continued steady growth from the At-Home segment (+1.5% y/y, +1.5% YTD).

Parent roll production was up +2.6% y/y, with domestic parent roll consumption also higher at +2.6% y/y. Tissue parent roll prices continue to rise, given upward pressure from pulp prices. While parent roll price increases are doing a better job at offsetting m/m pulp price increases (estimated by RISI to be at +$7/ton this month, based on 50/50 NBSK/NBHK), pricing for converted products appears to be more stubborn.

Exhibit 1: March U.S. Tissue Stats Summary

Source: RISI, RBC Capital Markets

G-P to close Augusta, Ga., USA tissue mill (33K tpy) – Earlier today, Georgia-Pacific announced it will permanently close its Augusta tissue mill (effective Q3 2018). According to G-P, the decision "comes after careful review of the current state of the mill and the tissue business." GP also cited increased competition in the tissue business and improvement in asset performance at other GP facilities, as well as the size and competitive cost position of the Augusta facility. RISI data indicates the mill produces ~33K tpy of conventional tissue (mostly napkin). As was the case with a closure announced by Kimberly-Clark in February, we weren't surprised by the announcement given current industry headwinds, and we should see more industry capacity rationalization. We had already modeled in a baseline of ~50K tons of capacity closures in 2018, with ~66K tons coming out in 2019 to account for the K-C Fullerton mill closure.

"Shrinkflation": Kimberly-Clark reduces sheet by "high-single" digits in push for an effective price increase. In response to rising pulp costs and, in our view, difficulty pushing price increases to retailers, K-C announced last week it is "reducing sheet counts for a consumer product price increase." With ~15% of NA tissue capacity, KC is a significant player in the industry and this move will be closely watched to see if other producers follow suit. Capacity adds: For capacity adds in 2018, ST Tissue is adding a conventional machine in Virginia, while Sofidel's two new NTT machines (150K tons) are expected to be online in Q1 2018 and Q3 2018, respectively. First Quality has two TAD machines coming online (~140K tons total) in Anderson, S.C. (Q4 2018) and Lock Haven, Pa. (Q2 2019) and one ATMOS machine (75K tons; Q4 2019) coming online. Clearwater's new Valmet NTT tissue machine at the company's existing facility in Shelby, N.C. is expected to come online in Q1 2019. The annual capacity of 70K tons will be spread across high-quality private-label premium and ultra-premium tissue products. Other capacity additions in 2019 include Georgia-Pacific's new TAD PM in Palatka, Fla. (80K tons, Q3 2019) and Irving's new TAD tissue-making machine from Valmet at its Macon, Ga., greenfield project (75K tons, Q3 2019). Most recently, Sofidel announced two conventional machines in Inola, Okla. (~130K tons total), which are expected to come online in Q1 2020 and Q2 2020, respectively.

Mill closures should counterbalance some of the new tissue PMs in the pipeline: While much attention is focused on the string of new capacity adds coming to the market in 2018- 2020, we continue to expect tissue makers to retire older machines as newer PMs are brought online (we previously assumed ~50K in capacity closures for 2018-2019). So far we have seen Kimberly-Clark announce the closure of two older machines (focused on facial tissue) at its Fullerton tissue mill (66K tons) for Q2 2019 and now we also have G-P closing a tissue PM in Augusta, Ga. (~33K tons).

RBC Dominion Securities Inc. Paul C. Quinn (Analyst), (604) 257-7048.

This information is provided courtesy of:

TAPPI

http://www.tappi.org/