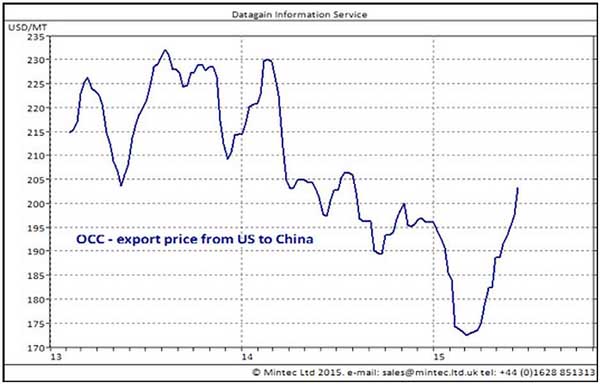

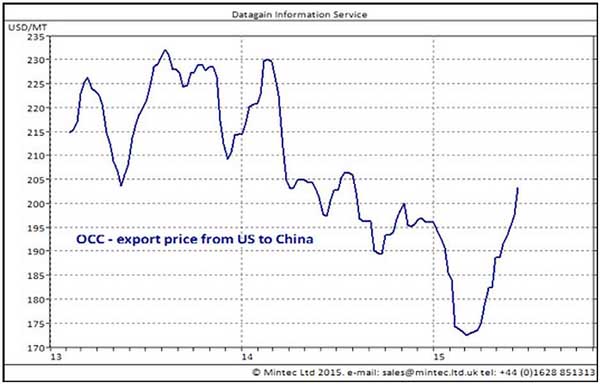

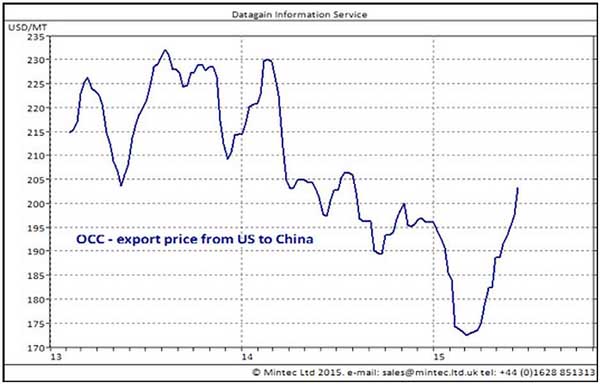

Corrugated Waste Prices Rise 20% Since March

According to a recent report by Spend Matters, Chicago, Ill., USA, the recycling industry is constantly growing as it is helping to protect the environment. Many government actions in the nation have been taken to support this growth over the years. For example, last year the U.S. expanded its single-stream recycling scheme to 80%, which makes it easier to recycle paper. Thanks to this kind of initiative, recovery rates grew about 15% in the last 10 years in the U.S., reaching 65.4% in 2014. The target is to reach 70% by 2020. The effort is definitely worth it. Industry specialists have determined that one ton of recycled paper saves up to 17 trees and as much as 185 gallons of oil.

There are many grades of recovered paper (waste paper designated for recycling). However, the grade most desired by paper producers is corrugated waste or old corrugated containers (OCC). This grade is usually collected from retailers, traders and the paper industry itself. OCC has low contaminants, making it easier to recycle, and the recovery rate as high as 89.7% (US, 2014). OCC is therefore the best feedstock for making new containerboards, which are used to produce boxes. We need a lot of boxes, as most of the commodities in the world require complex packaging and shipping-quality boxes.

Almost 40% of recovered paper is exported from the U.S., of which Chinese imports account for 70%. Since March this year, OCC prices have risen by nearly 20% and look like they’ll continue to head upward. This is because demand from China has increased since the end of the Chinese Spring Festival and their paper production plant maintenance period ended. Large Chinese paper producers such as Nine Dragons Paper and Lee & Man Paper have started preparing for the busiest box season, which began in July. Imports of recovered paper into China were 2.56 metric tons in April, up 11% month-over-month. OCC alone was 1.39 metric tons, up 8% month-over-month.

Looking forward, the demand for recovered paper is likely to increase in the U.S. domestic market but could decline in China. By the end of 2015, the US is expecting to add 1.0 metric tons production capacity of containerboard, as well as some new waste-based tissue paper machines. Both investments will need more recovered paper as a feedstock. In China, however, waste paper supply is expected to improve as the rainy season passes and the weather is more favorable for collections.

TAPPI

http://www.tappi.org/