Calculating the Value of Pulp and Paper’s Industrial Wastewater

BlueTech Research, Vancouver, B.C., Canada, a provider of water technology market intelligence, recently developed a comprehensive model for determining the quantities of wastewater and biochemical oxygen demand (BOD) that some of the major industries are producing, notably the pulp and paper industry.

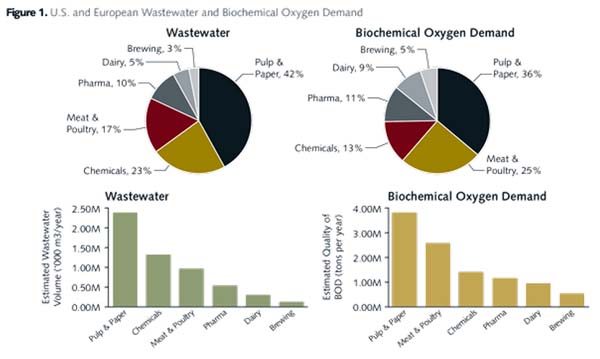

Focused geographically on the U.S and Europe, the study examines industries that include pulp and paper processing and manufacturing, as well as chemicals production, meat and poultry, pharmaceuticals production, dairy processing, and the brewing industry. Calculations were based on volumes of wastewater generated per unit of product processed or manufactured.

BlueTech identified a strong interest in more detailed understanding of the sub-sectors within industrial wastewater treatment, each with very different market dynamics, treatment trains, and "pain" points. Companies are looking for applications with higher margins for their technologies.

The industrial sector receives increasing attention from water technology providers due to opportunities presented by increasingly stringent regulations or growing production capacity, as is the case for craft brewing. The figure below, for example, shows the U.S. and European wastewater and BOD for the six industries identified.

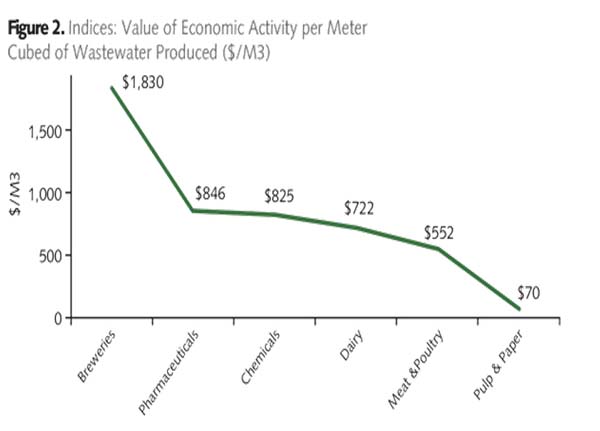

The indices presented in this next figure were calculated by studying the value of economic activity per cubic meter of wastewater produced. The chemicals industry represents the largest sector in terms of the value of economic output and revenue generation of wastewater, while the pulp and paper industry represents the smallest sector in terms of the value of economic output and revenue generation.

Research revealed that the pulp and paper industry generated the largest quantities of wastewater in comparison with the other industries due to the large quantities of water used per unit of product combined with historically rare water reuse. Unfortunately for this sector, the economic value of pulp and paper industry wastewater is currently one of the lowest in comparison with the other industries analyzed. The report highlights how this could create what could be opportunity in the rather large gap for innovation in this sector in the near future. Pulp and paper wastewater will likely be treated much differently compared with the other industries as soon as within the next decade as major players in this sector work to increase wastewater value in a newly expanded trans-industrial cycle.

While industries do not have a choice in relation to environmental compliance with discharge limits, the openness to invest in technology or to implement cost-saving options may be influenced by the significance of associated costs relative to the overall value of the activity it is supporting.

BlueTech's Insight Report, "Industrial Wastewater Treatment & Water Reuse in Six Key Industries," envisages the market opportunities in industrial wastewater treatment to be in resource recovery, particularly non-product water reuse, energy recovery, and biopolymer production. The report outlines several current water reuse industrial application examples in facilities such as Coca-Cola and breweries in contrast to the pulp and paper industry where reuse is much less common though theoretically possible with new technology.

Given that industries utilize vast quantities of water in their production processes (e.g., mixing, cooling, and washing), this report focuses on water usage within the aforementioned industries and the potential for water reuse within that particular industry. The report also investigates possible recovery of other resources such as energy nutrients.

Other report highlights include current innovative resource recovery technologies and approaches recently being applied in various industries, particularly in pulp and paper where output volume is largest and reuse still limited. New examples today include basic anaerobic treatment technologies that generate biogas, as well as advanced integrated treatment that combines anaerobic treatment with nutrient recovery. The report expects even more treatment technologies to "fill in" treatment capacity due to what will still be continually large waste water volume coming from pulp and paper production, an industrial process that is going to remain water intensive for the foreseeable future.

TAPPI

http://www.tappi.org/