Carthage Paperboard Managers Abandon Plans to Acquire Company

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

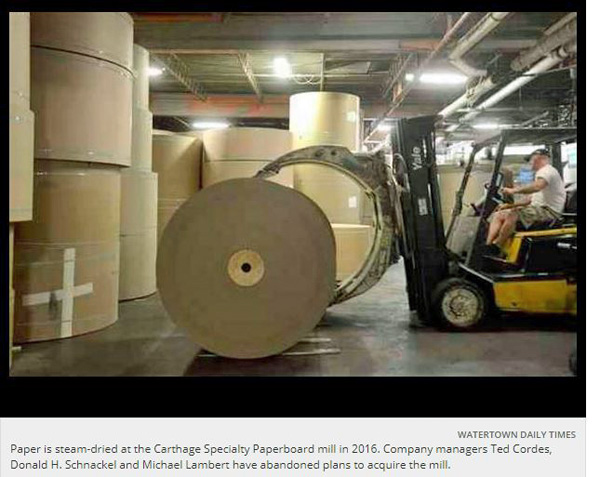

According to an Oct. 4, 2018 report by the Watertown Daily News (Jefferson, N.Y., USA) three Carthage Specialty Paperboard (also headquartered in N.Y. state) officials have abandoned their plan to acquire the bankrupt mill, leaving only one confirmed buyer left at the table.

VP of Sales and Marketing Michael Lambert said he, CEO Ted Cordes and VP of Finance Donald H. Schnackel could not secure the financing needed to comfortably submit an offer for a proposed auction of the manufacturer’s assets. The Jefferson County Industrial Development Agency approved a $250,000 loan in April to help the managers finance their purchase, but they only would have received it if they were the successful bidder.

Human Capital Investments (Starbuck, Wash.) remains as the only confirmed prospect aiming to purchase the West Carthage company, which makes paper products including mat board and cap closure board at 30 Champion St. Principals Ben Rankin, Seattle, and Phil Farmer presented a $9 million offer for it.

"Our main goal all along has been to give the mill a viable option," Lambert said. "We’re happy with the option coming forward and the process moving forward and that’s been our goal all along."

The mill’s owner, DeltaPoint Capital Management, filed for Chapter 11 bankruptcy in February after years of setbacks. If they acquire the paper mill at auction this month, Rankin and Farmer would rename it Long Falls Paperboard, invest $15 million toward plant upgrades, hope to increase production and possibly expand the manufacturer’s product line.

Farmer would oversee mill operations and Michael P. Cammenga, Carthage Specialty Paperboard’s former vice president of operations who informed Human Capital about the sale, would help direct the firm’s investments, Rankin said. The investment firm plans to keep a substantial amount of the plant’s existing staff of about 70 workers, but Rankin declined to comment on whether he and Farmer would retain Cordes, Schnackel or Lambert. Lambert said he hopes to remain with Carthage Specialty Paperboard.

"Obviously, some of them are very closely tied to DeltaPoint," Rankin said. "We hope to be the owner and do our best to manage the mill in a way we would like to see it run ... and bring in some new faces on the management side."

Carthage Specialty Paperboard officials are seeking a court order that would allow 17 "key employees" to receive a combined $300,000 from the possible sale, or payment from a buyer. That would include $75,000 each for Cordes, Lambert, and Schnackel should the court approve the request and a sale occur.

Payments would serve as incentives for continuing operations at the plant and executing "additional restructuring and sale-related responsibilities," particularly after six positions were eliminated since August 2017, which Lambert said resulted from workers leaving. Mr. Lambert did not comment on the court filing.

The JCIDA will review Human Capital’s request for help acquiring a $25 million bond for repairs and upgrades Thursday. The agency would serve as a conduit between the firm and a bonding agency. The company’s request for a $300,000 loan from the JCIDA was approved in September, and it hopes to secure additional loans from North Country Alliance and the North Country Economic Development Fund. Rankin and Farmer own or co-own several other companies in Washington state, including Conlin Columbia, Columbia OPSCo, Columbia Power & Waste and Columbia Straw Supply.