Paperboard Trays: Comprehensive Summary of Growth, Emerging Benefits

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

According to dual, collaborating Transparency Market Research (TMR) - based in Albany, N.Y., USA, summaries of a market report, and two similar / corresponding type HTF Market Intelligence market research summary reports (Paperboard Tray Market Report and Paper & Paperboard Tray Report) from Spring (in one case) and late Summer (for the other three summary reports) in March & Sept. 2018 all focus on the researched segment within the P&P products market named "paperboard trays".

According to the most recent report summary published this past Friday, Sept. 14, this is the standing of the paperboard tray market as summarized by data studied in the research results of the segment studies done in detail (and for-purchase) supplied by TMR:

According to the most recent report summary published this past Friday, Sept. 14, this is the standing of the paperboard tray market as summarized by data studied in the research results of the segment studies done in detail (and for-purchase) supplied by TMR:

- The rising worldwide demand for sustainable and flexible packaging applications in various industries, notably in the food and beverages industry, is a key factor driving the global paper and paperboard trays market.

- Rising demand for cost-effective paperboard packaging for food and beverages is a vital factor supporting the demand for paper and paperboard trays. A wide array of benefits offered by these containers to end-use industries, such as retail differentiation, thermal stability, and moisture benefits, is boosting the uptake in various regions.

- Stricter implementation of global food safety standards in several developed countries has led to a wider adoption of paper and paperboard trays for disposable foodservice packaging applications.

- A number of supply chain concerns and cost constraints faced by players in the paper and paperboard packaging is a critical factor likely to negatively influence the growth of the market to an extent. On the other hand, several manufacturers are investing in new materials and better water technologies to address these concerns.

- The advent of customizable trays for premium quality food grade packaging is a crucial trend expected to open exciting avenues during the forecast period. In addition, the striking flexibility of vast graphics printability possible with corrugated boxes helps in upping the brand appeal, thereby bolstering their demand. This includes a new packaging production era in this late part of the decade and entering the 2020's of customization and personalization.

-

- The advent of customizable trays for premium quality food grade packaging is a crucial trend expected to open exciting avenues during the forecast period. In addition, the striking flexibility of vast graphics printability possible with corrugated boxes helps in upping the brand appeal, thereby bolstering their demand.

- Digital technology in the production line is making personalization and complex varying automated line-up possibilities realistic and obtainable - visions are no longer limited by the traditional "analog" constrictions of package production, press / printing lines, etc. that are capable of digital multi-dimensional "smart" programming seamlessly varying, without any significant interruption to the line, so as to produce "unique" products (personalization of packaging is considered a key trend driving paperboard packaging as a 'luxury' feature).

Pictured above: These familiar / common small-medium size food service containers are economical and sustainable as benefits for the product that is also enhanced in its ability to handle water exposure in its contents long enough for people to comfortably eat without their disintegration (a problem only existing in the extreme economy market / developing world markets for such containers that mimic the current top international standard for basic food-service paper trays).

As note to sales-related micro-targeting of clientele: These types of economical food trays also can imply a specific nostalgic accent / retro appeal (such as in the picture above) to certain businesses desiring this image. "Extended Reinforcements" in the raw product beyond the standard brown (unbleached or coated / usually washed of unsafe food chemicals in many regulated economies, but beyond this is an "exposed paper" product) are a key to a much wider range of immediate serving of casual dining food and even for use in mobile vending situations where product is placed in the packaging at POS and not traditionally as a storage medium.

Afterwards, the compost and fast breakdown ability of these economical types of trays can be considered a plus. This can simplify business needs (such as trying to effectively dish-wash contaminants from commercial plastic trays / used crates) without raising costs or hurting environmental image.

Other materials such as glass and ceramic are also more fragile and can create a shattering hazard posing possible customer and employee danger of injury that paper trays for food service will not cause due to the generally favorable flexibility properties of this type of thin paperboard generally used to make the small-medium sized / single portion containers.

Regional Analysis (according to TMR summarization of up-to-date research data published Sept. 14):

Asia Pacific excluding Japan (APEJ) holds the dominant revenue shares of the global market and is expected to retain its lead throughout the forecast period. The APEJ paper and paperboard trays market is predicted to create an absolute opportunity estimated US$607 Mn during 2017–2022. The dominance of the regional market can be attributed primarily to the substantial demand for cost-effective and sustainable packaging, especially for food grade applications. Of all the material types in making paper and paperboard trays, corrugated board is the leading segment and is projected to witness dominant growth, in absolute terms, over the assessment period.

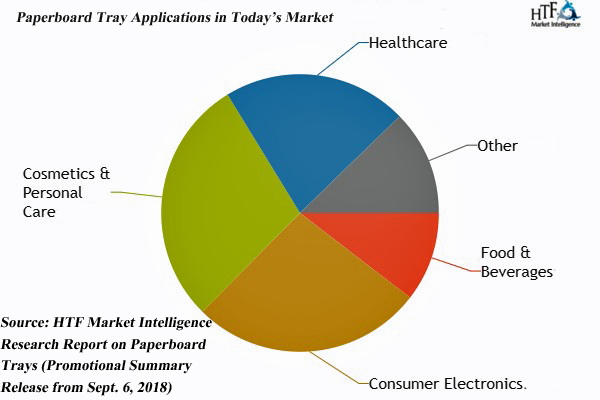

Pictured above: Additional possible modern uses and applications (industrial and commercial consumer / purchaser segments) for paperboard trays or tray formulation / composites that include pulp & paper based fibers and/or include a specific type of paperboard grade (traditional) as a part of their design / construction model.

Competitive Dynamics (according to TMR summary of research Sept. 14):

Competitive Dynamics (according to TMR summary of research Sept. 14):

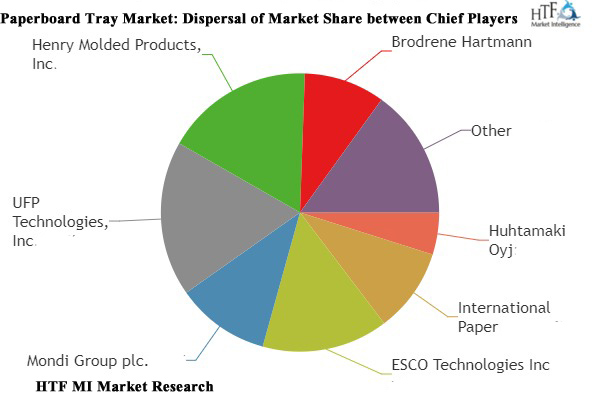

A number of emerging and prominent players are offering high-performance paperboard packaging solutions with superior benefits and properties for a diverse end-use industries, in order to gain a competitive edge over others.

Some of the leading players operating in the paper and paperboard trays market mentioned and studied here included: International Paper Co., Huhtamaki Oyj, Mondi Group plc., ESCO Technologies Inc., Brodrene Hartmann A/S, UFP Technologies, Inc., Henry Molded Products, Inc., Pactiv LLC, OrCon Industries Corporation, and Fibercel Packaging LLC.

Dual Summary Spotlight / Expanded Firm Perspective Public Release Info.:

Dual Summary Spotlight / Expanded Firm Perspective Public Release Info.:

Transparency Market Research other most recent report available on the specific segment of "paperboard trays" released prior to the most recent information available on the news-wires is included here as well, printed for additional focus (summarized March, 2018) in this edition of OTW. In this similar type of research summary, TMR effectively explained the drive for demand in more specific terminology as concluded from their full research report here, as follows:

Focusing on Sales, Marketing of the Product:

Focusing on Sales, Marketing of the Product:- This is a paper product sector that will likely respond to solid demand going into the 2020's.

- When suggesting the need to order for the future and for businesses to plan for the future, it is important to note that businesses have recently not only been able to claim sustainability benefits from using sustainable sourced paper-based serving / storage mediums, but paper-based tray solutions have also been found to be a space-saving, often weight-saving solution, such as this past month when OTW focused on an international transport provider that had attained significant benefits from transforming to a paper packaging based solution.

- The advancement of paper straw technology and its corresponding market rise will likely apply to more spill resistant applications in papers for traditional liquids just like the grease-proof / grease-durable paper segment for food product wrapping has recently matured as a segment for handling oils.

Market Projection Specifics by TMR (Spring 2018 research report summarization): The global paper and paperboard trays market is projected to rise from a valuation of $4.444.3 billion in 2017 to reach a worth of $5.894 billion by the end of 2022. The market is predicted - in this previous summary - to clock a CAGR of 5.8% during the periods studied (early 2020's).

HTF MI Research was additionally studied as part of this collective research summary study because of a summary release that was recent and likewise relevant as of Sept. 6, 2018 release by a third party publisher focusing specifically on the paper product manufacturing segment titled "paperboard trays".

HTF MI Research was additionally studied as part of this collective research summary study because of a summary release that was recent and likewise relevant as of Sept. 6, 2018 release by a third party publisher focusing specifically on the paper product manufacturing segment titled "paperboard trays".

Corresponding HTF MI Competitive Analysis Summary (Sept. 6):

The key players are highly focusing innovation in production technologies to improve efficiency and shelf life. The best long-term growth opportunities for this sector can be captured by ensuring ongoing process improvements and financial flexibility to invest in the optimal strategies.

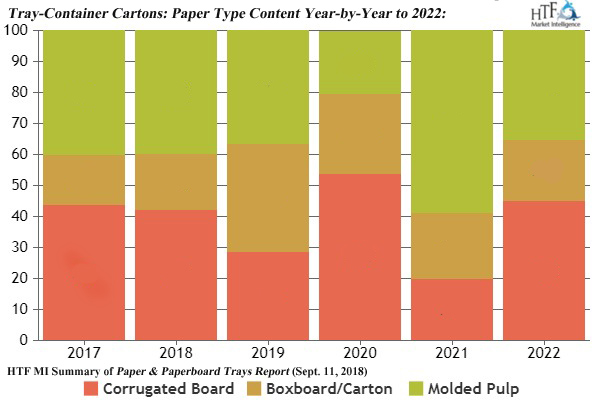

The following graphical information about the dispersion of paper-based materials in paperboard & paper-based trays is available from the similarly broader segmented research report released alongside the Sept. 6 promoted summary of the paperboard trays market and in this case is from a Sept. 11 promotional summary of the separate, recent (but similar) report titled Paper & Paperboard Tray Report also by HTF Market Intelligence (HTF MI) with a projected period extending from within the current year (2018) to 2022 (five year trajectory model).

Graphic above: Throughout the past year, the current year, through a total of a five year future trajectory there is not expected to be any significant lasting shift / trend as far as the favored grade of tray paper-based board material or bio-mold (such as molded pulp). Instead, the number of demands for boxboard / cartonboard grade in paperboard tray making seems to remain relatively steady during the current period and immediate years ahead. Corrugated board is projected as a grade in tray containers to fluctuate with no key trend, indicating a possible situation where the demands are changing on the whim of market impulses as opposed to a flat out winner in tray-building P&P based materials emerging in the forecast period. Molded pulp and/or corrugated board seem to displace each other as the desired grade in any given years' proportion of construction materials used in the tray manufacturing process depending on market factors; both seem to have found suitable designs / specified formulations within each raw material sub-sector to satisfy tray-based packaging needs of a multitude of different uses and industrial segment needs within the consumer base.

Key players from the complete studies available as noted by HTF MI inclcude: Huhtamaki Oyj, International Paper Co., ESCO Technologies Inc., Mondi Group plc., UFP Technologies, Inc., Henry Molded Products, Inc., Brodrene Hartmann A/S, Fibercel Packaging LLC., Pactiv LLC & OrCon Industries Corporation etc.