Weak USD and the Impact of China Paper Industry’s Overseas Investment

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

By Neo Wu, Senior Consultant, Fisher International Inc., Norwalk, Conn., USA.

During the January 2018 Davos World Economic Forum in Switzerland, American Secretary of the Treasury, Steven Mnuchin, endorsed the dollar’s decline as a benefit to the American economy and Secretary of Commerce, Wilbur Ross, said the U.S. would fight harder to protect its exports.

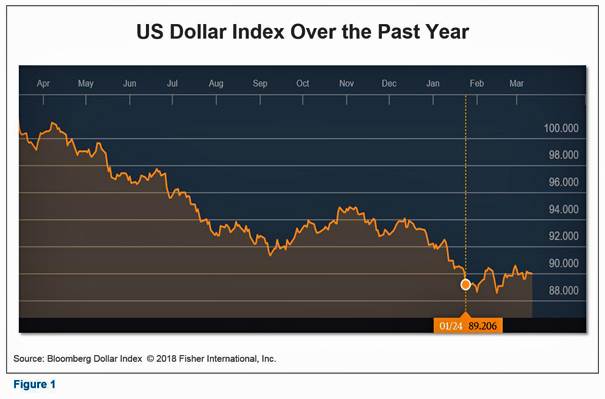

President Trump stated just one day after Mnuchin’s statement that he wishes to see a strong dollar. The market seems unconvinced by Trump’s remark as reflected in the dollar index of the past year, tracked by the Bloomberg Dollar Index in Figure 1 below. The dollar reached its lowest in three years according to Bloomberg’s measurement. Global investors have sold U.S. currency partly because of their concern over Trump’s protectionist tendencies.

Indeed, it appears that what Mr. Trump said was primarily intended to buttress the dollar. In the past year, from early 2017 when the dollar index was about 103 to today when the index was less than 88, the dollar depreciated more than 10%. A weaker dollar anticipation and the current U.S. policies may drive the Chinese investment primarily in the U.S. and Europe to another level.

What is the potential impact of current U.S. policies on Chinese paper investment in the U.S. and Europe? Common sense tells us that a weak dollar will help U.S. exporting, which may be an incentive for overseas investors, such as Chinese fund managers, to spend capital on both M&A or greenfield projects in the U.S., with manufacturing built in U.S. but targeted for consumption in other regions.

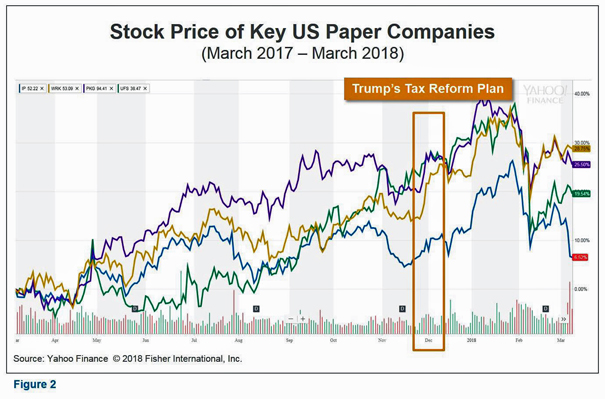

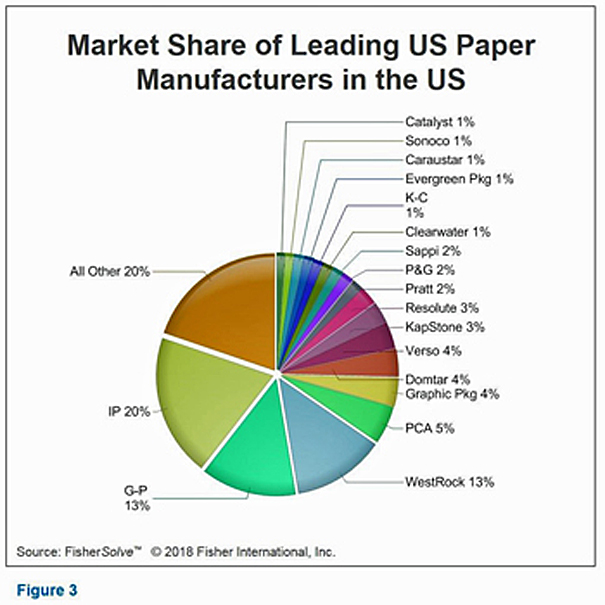

It is also important to look at the impact of Mr. Trump’s tax reduction program on the current major American paper producers’ stock. Figures 2 and Figure 3 above show the leading U.S. public paper companies stock price in the past 12 months and their relative market share in the U.S. The market was highly responsive to the tax plan and the weaker dollar expectation pushed the stock price even higher.

It is obvious that the anticipated weak dollar along with the U.S. tax reform provides significant motivation to Chinese capital in search of investment. In the paper industry, an ever-increasing number of Chinese companies are looking for investment opportunities in the U.S., like the recent announcement by Sun Paper about the new plan to make linerboard, and Shanying International’s purchase of a majority stake in Boreal Bioref in Europe. This targets European and U.S. domestic consumption as well as exporting opportunities to Chinese firm’s domestic market, a fast-growing China market, instead of the previous plan to make rayon at this site.

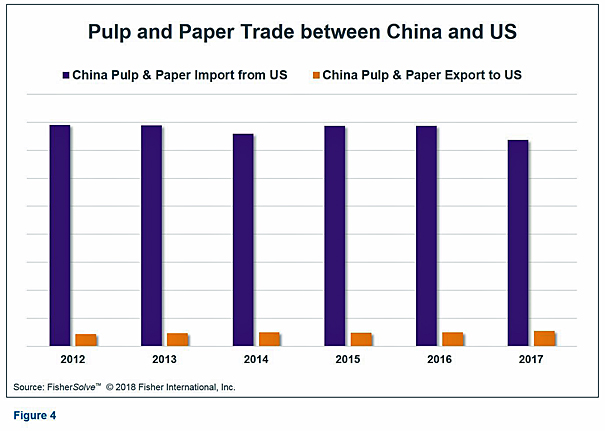

Anecdotally, Fisher has observed evidence of rapidly expanding interest among Asian players in better understanding the U.S. market. However, every coin has two sides. The weak USD against the Chinese CNY may help Chinese capital investment in the U.S. and exports back to China, but it may also hurt the Chinese exporting business to a great extent. Luckily, the Chinese paper industry is primarily fibered by imports (market pulp, OCC, etc.) but the consumption is built on huge domestic demand with most paper products consumed within China.

As Figure 4 below shows, China has a net gain of traded pulp and paper between China and the U.S. It is primarily based on the model that China imports wastepaper from the U.S. and ships well packed value-added products, such as iPhones and Nike shoes to the U.S.

With the globalization of the Chinese paper industry, we speculate more Chinese paper companies will seek opportunities to expand their balance sheet through overseas activities. Meanwhile, Trump’s policies makes America an even more favorable investment destination for Chinese capital. However, how to best execute the investment strategy, where to find ideal investment destinations, is an obstacle for many Chinese investors.

Neo Wu can be reached by email, or:

Fisher International, Inc.

50 Water Street

Norwalk, CT 06854 USA

+1 203 854 5390