Fortress Paper - A $240 Million Dilemma

![]() Print this Article | Send to Colleague

Print this Article | Send to Colleague

According to a report earlier this week by Value Walk LLC, New York City, N.Y., USA, the once successful, seemingly mistake-free executive of Fortress Paper convinced investors to pour more than $240 million into a Thurso, Que., Canada, pulp mill, and it was "a great story while it lasted." Fortress Paper Owner Chad Wasilenkoff, the report says, was a "high-flying guy," and a few years ago, so was his company. In 2011, Fortress Paper stock hit $62.89.The stock has since lost 97% of its value, closing last Friday at $2.15. Fortress announces its year-end results on Monday.

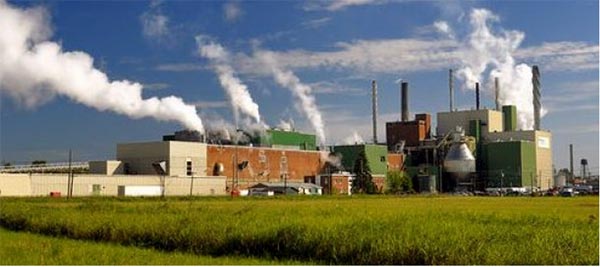

The answer to what went wrong lies far from the glamourous world of the jet-set, in Thurso, a village of 3,500 on the Ottawa River 40 km east of the nation's capital, the report continues. Thurso is famous for two things in Canada—Guy Lafleur, the all-time leading scorer of the Montreal Canadians; and its pulp mill, which opened in 1956.

Five years ago, Wasilenkoff convinced investors to buy the mill for $1.2 million and pour in $240 million to convert it from production of kraft paper to dissolving pulp, the raw material of rayon fiber and a host of other specialty products. The investment included $150 million from Quebec and a union investment fund.

"It was a great story while it lasted," recalls one forest industry watcher in Western Canada. "You had floods in Pakistan and droughts in China, devastating the cotton crops. Dissolving pulp hit $2,500 per metric ton. Thurso's capacity times $2,500 a ton equaled a lot of money."

Then everything seemingly went wrong. Other mills converted to dissolving pulp. The price of dissolving pulp crashed to $800 per metric ton. China slapped a 13% duty on imports from the Thurso mill. And the mill conversion job, Wasilenkoff said, "came in $100 million over budget by the end of it all.

"It has been the most difficult thing I have had to manage in my life," Wasilenkoff added in the article. "I hired the wrong people to do the conversion. My management team gave me wrong financial forecasts. We kept running out of money."

Until fairly recently, Wasilenkoff had a remarkable run. To hear him tell it, he earned huge sums as a child, fishing golf balls from ponds, buying and selling Atari computer games, BMX bikes, skateboards, artwork, diamonds and gold. He bought and sold cars before he was old enough to drive.

But when he invested the proceeds in shares, he ran into some trouble, but went on to do well. On graduation from University of British Columbia with a degree in urban geography and economics, he learned the investment business at Canaccord Capital in Vancouver. He invested in gold and uranium when they were undervalued. In 2006 he began investing in a very depressed asset—paper mills.

Initially he did well in the paper business, too. Fortress bought a wallpaper mill in Dresden, Germany, for EUR 5 million, and Landqart AG in Switzerland, which makes security paper to print euros and Swiss francs. "That company was losing $20 million a year. It's now producing positive earnings in the $10 million per year plus range," said Wasilenkoff. In 2013 Fortress sold the Dresden mill for EUR 160 million.

Fortress also bought a company from the Bank of Canada that makes security threads for paper currency, for $750,000, and sold it last year for EUR 17.5 million.

"We have had a lot of successes within Fortress, and one really bad investment," said Wasilenkoff. "Thurso has been a disaster."

But today, with spring in the air, there are signs of life at the Thurso mill, which employs 335 people. René Emond, president of the mill's union, praised Yvon Pelletier, who came from competitor Tembec in 2013 to take over the Thurso mill.

"If we'd had him in 2010 we'd be in better shape," Emond said. "He talks and listens to the guys on the shop floor." The mill now also produces 18 MW of electricity for Hydro-Québec.

"I hope that investors can look at this over the medium and long term," said Emond. Some workers have bought Fortress shares; he has not: "I'm not a gambler."

Brian McClay, a global pulp market analyst based in Montreal, is cautiously optimistic about Fortress. "Pulp is a simple business, but it's never easy," he says. "They've got the product quality where it needs to be. It could become a good investment."

McClay has another reason for optimism. "Microplastic pollution in the oceans is linked to polyester fiber. Rayon is based on wood fiber and is biodegradable," he says.

Wasilenkoff says of the company, "We are on the verge of profitability."