| Monday, June 20, 2011 | Archives | Advertise | Online Buyer's Guide | FLEETSolutions |

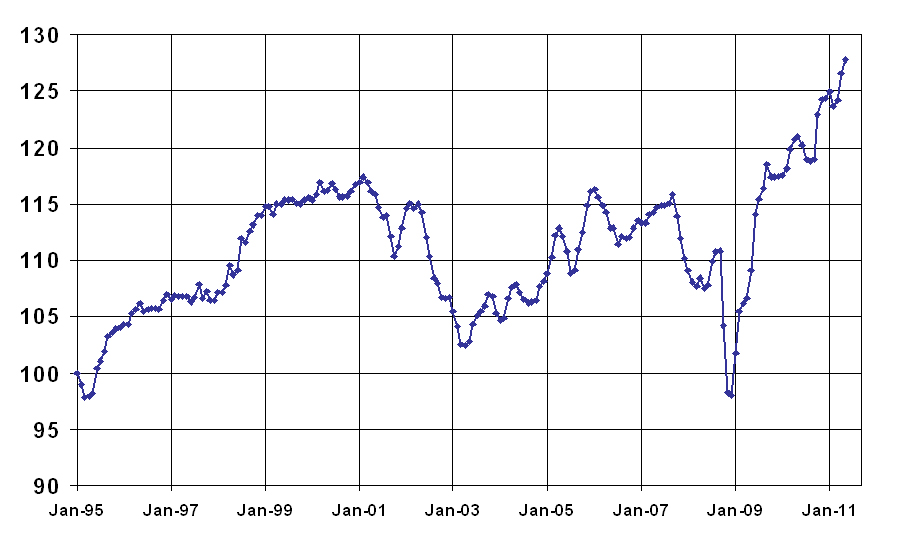

Fleet Managers Take Action In Record-Breaking Wholesale Market

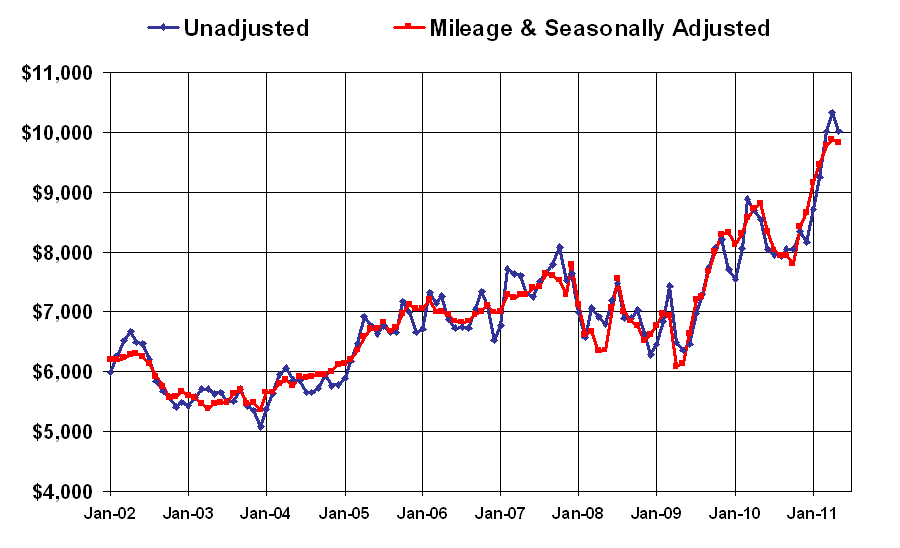

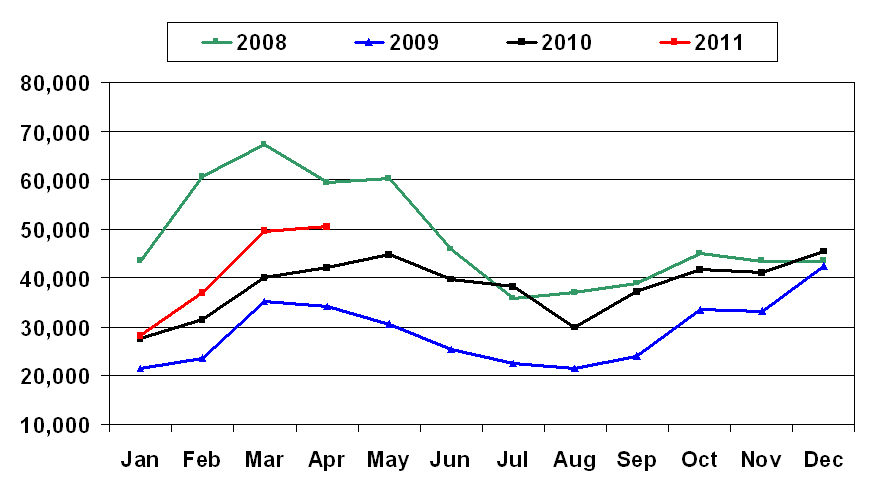

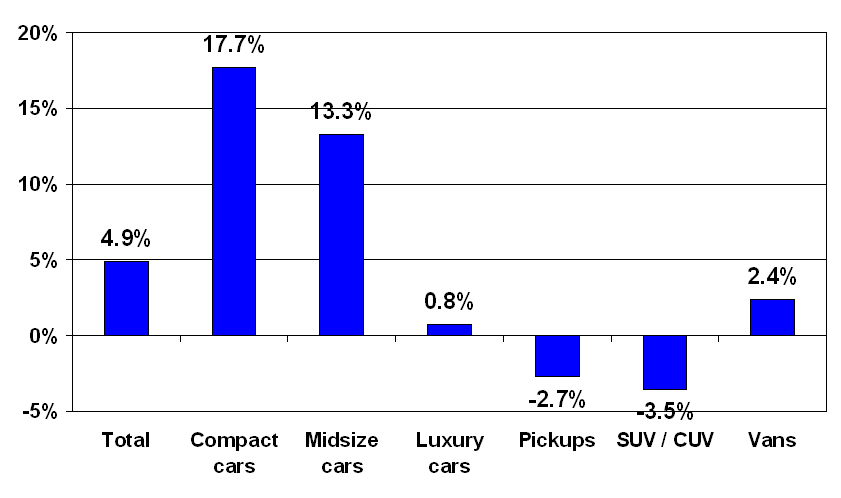

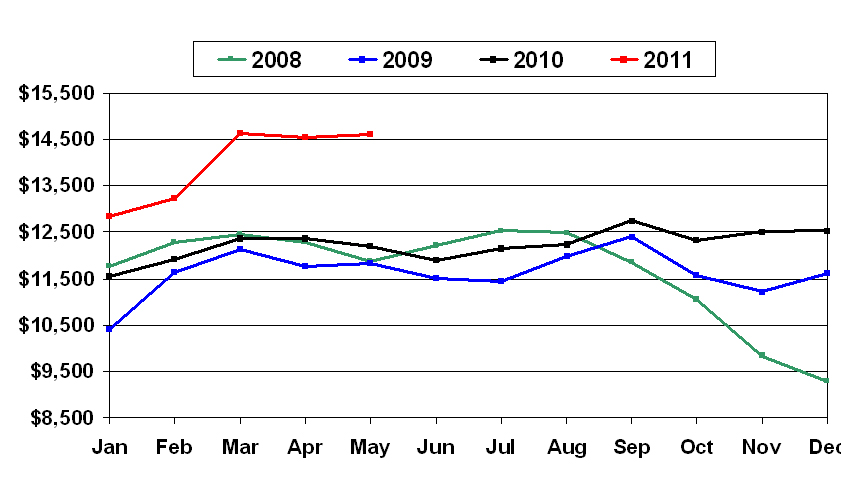

After reaching a record high of their own in April, end-of-service midsize fleet car prices (on a seasonally adjusted basis) dipped only marginally in May to rest at their second-highest level ever.  And, although prices for pickups have been soft in the overall wholesale market, those being sold by commercial fleets have enjoyed higher prices recently. In some instances, fleet managers have taken this opportunity to cycle out early, especially when attractive pricing is offered for replacement units. Total new vehicle sales into commercial fleets topped 51,000 in May, continuing a 2011 sales pace that far exceeds that of the past two years.  As sellers in the wholesale market, fleet managers have noticed in recent months that the natural limit to which used vehicle values can rise has been increased by higher transaction prices and leaner inventories in the new vehicle market. In addition, wholesale auction supplies have remained constrained as a result of lower commercial consignments. In particular, wholesale prices for compact cars have been soaring. On a mileage-adjusted basis, compact car prices in May were up more than twenty percent from their year-ago level. The annualized price rise accelerated even further over both the last six months and the past quarter. This reflects inventory shortages in the new vehicle market, the impact of higher pump prices, a shift in consumer preferences beyond what gas prices would suggest, and better product offerings in this segment.  Rental risk vehicles are also commanding exceptionally strong prices at auction.  In May, a straight average of auction prices for rental risk units remained above $14,500 for the third consecutive month. This is the result of better product offerings, reduced supplies, and strong demand for these units. The reduced availability at auction stemmed from the twenty-one percent decline in new vehicle sales into rental during the month (according to Bobit Business Media) while, at the same time, the total rental fleet size was growing. The average mileage of rental risk units sold at auction moved above 40,000 miles in May. In the second half of 2011, we expect the volume of off-rental units will rise and, in the near term, so too will the average mileage.  Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. Tom Webb is chief economist for Manheim Consulting. Contact him at Thomas.webb@manheim.com, follow him via Twitter at www.twitter.com/TomWebb_Manheim and read his blog at www.manheimconsulting.typepad.com. |

|

NAFA Fleet Management Association 125 Village Blvd., Suite 200 Princeton, NJ 08540 Telephone: 609.720.0882 Fax: 609.452.8004 |